It's a low-fee solution backed by expert advice and support when you need it.

Lower fees mean more savings for you1

Use the sliders to see how much money you can save*

MD ExO Direct -

Traditional mutual funds1 -

Estimated savings per month*

Additional return over time**

30 YEARS

*The savings represent the additional monthly contribution you’d have to make at a financial institution with higher fees to earn the same return over time as you could with MD ExO Direct.

**This amount is an estimate of the additional return you could achieve by moving your money (initial contribution and planned monthly contribution) to MD ExO Direct.

Choose MD ExO Direct if you want:

Expertly constructed portfolios that match your goals and risk tolerance.

You may choose to invest in MD ExO Direct using either actively managed funds or index replication strategies. Both utilize tactical portfolio rebalancing, as MD believes this approach will provide an opportunity for improved investment performance. You are able to open an account with as little as $25!

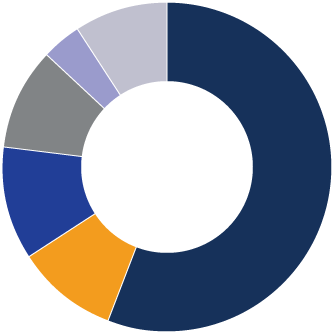

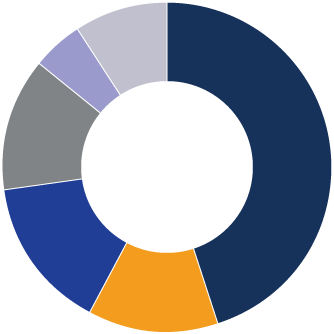

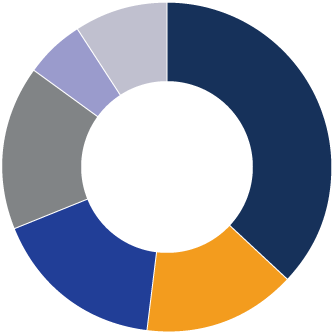

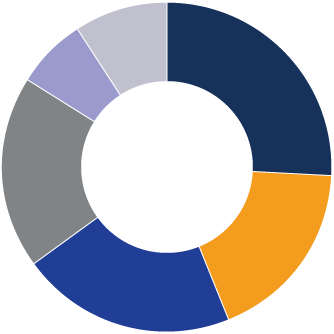

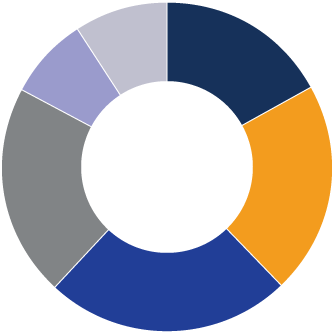

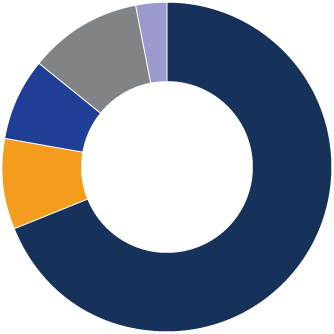

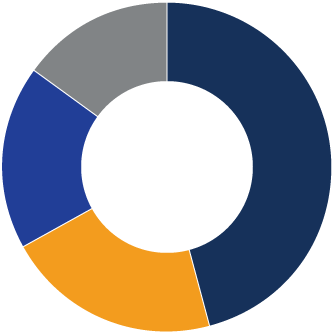

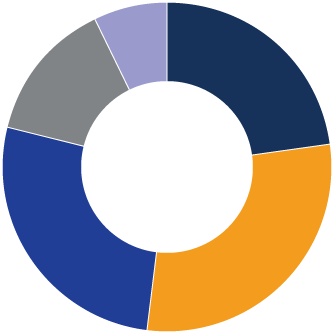

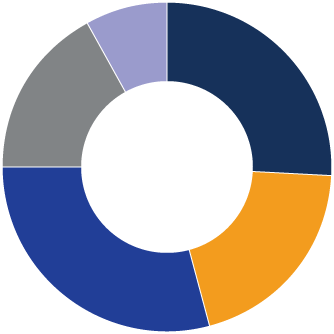

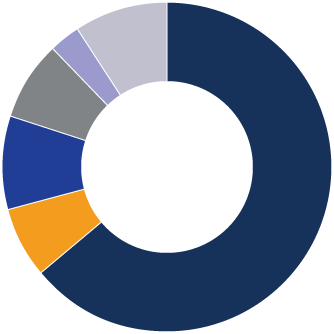

Strategic asset allocation

| Fixed Income | 64% |

|---|---|

| Canadian equities | 7% |

| U.S. equities | 9% |

| International equities | 8% |

| Emerging Markets equities | 3% |

| Alternatives | 9% |

MD ExO Direct portfolio recommendations use the F2 series of units offered by MD Precision Portfolios™ and the MD Money Fund. Specific portfolio recommendations will depend on your investment goals, tolerance for risk and other information about your unique financial situation.

Contact the MD ExO Direct Advisory Team

Phone

1 800-267-2332

Monday to Friday, 8 a.m. to 6 p.m. ET

(Press 4 when prompted)

Live chat

MD ExO Direct online platform

(Available after you sign up)

Frequently asked questions

You can fund your MD ExO Direct account in three ways:

- through a one-time deposit

- by scheduling a pre-authorized contribution

- by transferring cash from an existing account with MD or another financial institution

Yes, you can open as many accounts as you would like.

MD Management Limited displays your return using a money-weighted return process, which takes into account the returns you earn on deposits, as well as the returns on your investments.

Your account will be invested in an MD Precision Portfolio or the MD Money Fund.

MD Precision Portfolios are made up of underlying funds and feature a regularly rebalanced structure that keeps your portfolio’s asset allocation on track and helps you achieve your financial goals.

The MD Money Fund is not made up of underlying funds and, therefore, does not need to be rebalanced.

Maintaining your confidentiality and protecting your personal information are fundamental to the way we do business with you.

Our privacy policies detail how our financial services and practice management business groups collect, use and disclose your personal information.

Where applicable, privacy statements have been developed to provide you with details about our information-handling practices for the specific products and services that you use.

These policies and statements are available from the MD ExO Direct advisory team and on our website.

The privacy policies and statements are designed to provide a cohesive framework to guide MD Financial Management’s information-handling practices.

- Non-registered investment account (Individual & Joint)

- Tax Free Savings Account (TFSA)

- Registered Education Savings Plan (RESP)

- Registered Retirement Savings Plan (RRSP)

- Spousal Retirement Savings Plan

- Registered Retirement Income Fund (RRIF)

- Spousal Retirement Income Fund

- Locked-in RRSP for federally regulated plans (LRSP)

- Locked-in RRSP for provincially regulated plans (LIRA)

- Restricted Locked-in RRSP for federally regulated plans (RLSP)

- Locked-in RIF for provincially regulated plans (LIF)

1As of December 2017, the average, asset-weighted management expense ratio (MER) for the Mutual Fund of Funds category was 2.08%. Source: Investor Economics Fee-based Report, Winter 2018.

The graph shows the potential savings from the average management fees, applicable taxes and management expense ratio (MER) for MD ExO Direct (1.17%) relative to an average management expense ratio (MER) of comparable mutual fund categories (2.08%). The potential savings are based on the initial deposit, expected growth rate, investment time horizon, and monthly contributions you selected. The calculation assumes that the initial deposit is made at the beginning of the indicated period, and the same amount is contributed annually until the end of indicated period.

The graph assumes annual compound growth at the selected rate in its calculations.

The expected rate of return is intended to represent the expected returns of your current investment strategy and should not be considered a recommendation. The expected rate of return used is net of inflation.

This information is presented for illustrative purposes only. The expected rate of return and savings are not a guarantee and the actual rate of return from your savings and investments will likely be different.

The total shown for strategic asset allocation or investment mix may not add up to 100% due to rounding.